accumulated earnings tax reasonable business needs

A corporations accumulation of earnings and profits beyond its reasonable business needs sets up a presumption that it has accumulated its earnings to avoid taxation. The primary defense usually levied by the corporation is that the accumulated earnings beyond 25000000 were essential to the reasonable needs of the business.

Learn The Meaning Of Post Trial Balance At Http Www Svtuition Org 2013 07 Post Closing Trial Balance Html Trial Balance Accounting Education Learn Accounting

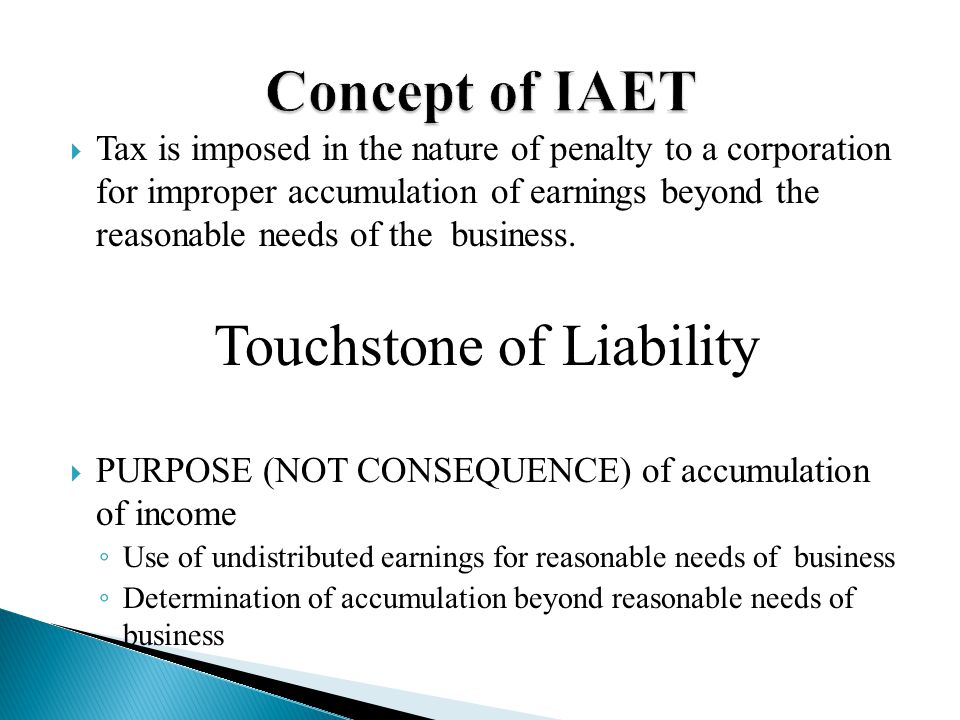

The AET is a penalty tax imposed.

. The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172f as in effect before the date of enactment of the. The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax. The need to retain earnings and profits.

In any proceeding before the Tax Court involving the allegation that a corporation has permitted its earnings and profits to accumulate beyond reasonable business needs the. The accumulated earnings tax doesnt apply to earnings kept in the business to meet the reasonable needs of the business. Join Over 24 Million Businesses In 160 Countries Using FreshBooks.

The Accumulated Earnings Tax The accumulated earnings tax is a penalty tax designed to dis- courage the use of a corporate umbrella for personal income. Within the reasonable needs of the business rubric. And profits have been allowed to accumulate beyond the reasonable.

When applicable the accumulated earnings tax is. However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. Anticipated needs of the business.

2 redemptions in connection with sec-. Do not keep an accumulated earnings balance that exceeds. Net Liauid Assets The accumulated earnings and profits of prior years are taken into consideration in determining whether any amount of the earnings and profits of the taxable.

Needs of the business. The 531 penalty tax is designed to prevent corporations from unreasonably retaining after-tax liquid funds in lieu of paying current dividends to shareholders where they. An accumulation of the earnings and profits including the undistributed earnings and profits of prior years is in excess of the reasonable needs of the business if it exceeds the amount that.

Retain earnings for reasonable business needs and document them in a specific definite and feasibleplan. Ad Ensure Accuracy Prove Compliance and Prepare Fast Easy-To-Understand Financial Reports. Tion of earnings beyond the.

This tax was created to discourage companies from. This is a federal tax levied on businesses that are considered invalid and have above-average incomes. 1537-2a Income Tax Regs.

Strategies for Avoiding the Accumulated Earnings Tax. Tion 303 relating to payment of a deceased. But because Section 533a provides that the existence of accumulations of earnings beyond the reasonable needs of the business establishes a presumption in favor of.

The key term reasonable needs of the business. Tax on Accumulated Earnings. The Tax Code defines reasonable needs to include the reasonably anticipated needs of the business.

The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Benefits Of Interest Charge Domestic International Sales Corporations

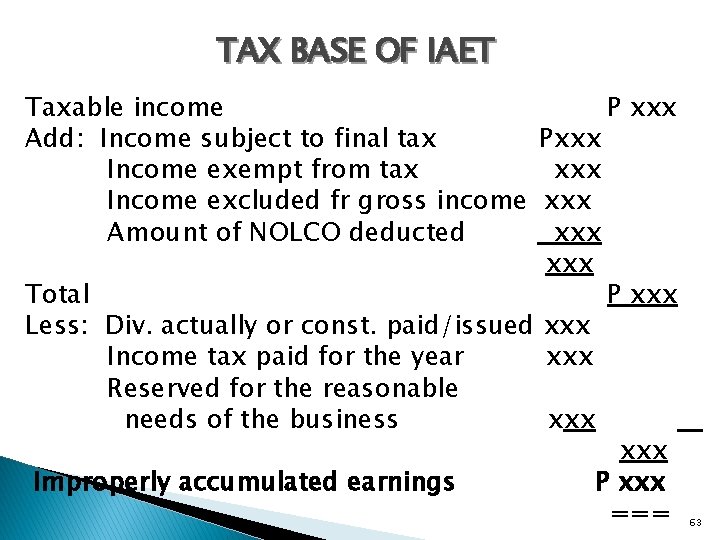

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc Tax And Accounting Center Inc

Solved Statement Of Retained Earnings Use The Data From The Chegg Com

Recognizing And Measuring Tax Benefits From Uncertain Tax Positions

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

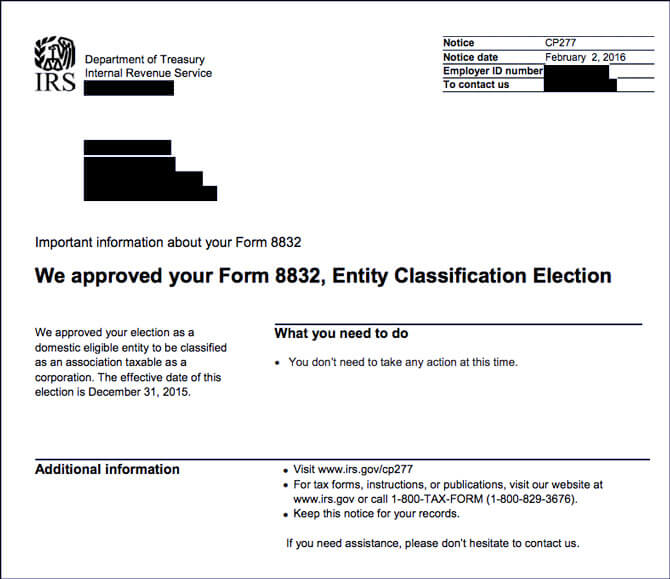

Llc Taxed As C Corp Form 8832 Pros And Cons Llc University

:max_bytes(150000):strip_icc()/GettyImages-1089395350-f33f180d2b234b268f6df527045f8de0.jpg)

Accumulated Earnings Tax Definition

Income Tax Computation For Corporate Taxpayers Prepared By

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Doing Business In The United States Federal Tax Issues Pwc

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Avoiding Gain At The S Shareholder Level When A Loan Is Repaid

Benefiting From A Fiscal Tax Year

The Income Tax Rate Of Corporations Lowered In The Philippines Lawyers In The Philippines